#Adaptrade builder software trial#

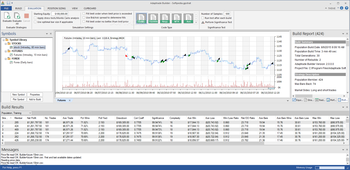

I also build alot of multitimeframe strategies and here you can find an edge by to cleaning up market noise using a higher timeframe and that and the other features announced for SQ4 are actually a big reason i bought SQ after the trial period.It seems to me that SQ team is a really good team and SQ3 with all current addons is unmatched and of course just sitting and programming for perfection does not pay the bills. It does unfortunately not help much and are usually in reality highly curve fitting. I used that a lot for last 2 year manually building strategies in another awesome tool. Neural network as dirkdiggler was commenting on is cool and are infact used as a fuzzy logic to evaluate the entry point given by the strategy. Intraday i find impossible not because of SQ but just impossible but that said it might be so that i do not know what i am doing. You can find profitable strategies for sure using SQ. I have to admit that I did not have any success with SQ either. I’m beginning to think SQ may fall closer into that category.ĭirkdiggler, I agree, the “webinar” was awful, reminiscent of some sales pitch to ignorants. Futures are obviously highly regulated and not riddled with scam artists selling some magic forex system. If you want to trade currency trade currency futures. But once you know the games, fraud and corruption that occurs in the spot forex market you will realize it’s not the place to be trading at all. Knowing the flaws of both pieces of software will keep you out of trouble. Ultimately you can very easily over fit your systems in both adaptrade and SQ if you’re not careful and they could easily fall apart in real time. You can also get a hold of the support person at adaptrade via email directly. It also has a statistical t-test significance test which is commonly used by fund managers. You can also evolve the position sizing method and quantity with risk of ruin calculation all built in, which is very important. It has a wide array of commonly used position sizing methods by real world money managers…not just % of equity like in SQ, which doesn’t work in Ninja anyway. Adaptrade has neural network functionality and you can build the fitness function to your objectives. SQ works faster but I have yet to generate a single profitable intraday strategy with it.

But I do like Adaptrade a lot better overall.

They really need to focus more on fixing the problems in SQ and less on e-books and webinars and all the other nonsense they send out via email. Would you mind in a few words compare the two? I trade, or at least attempt to, trade futures and so far I am disappointed with SQ.

Do you use Adaptrade? You are on this board so I assume you use SQ.

0 kommentar(er)

0 kommentar(er)